The South African Paradox: We’re Insured to Die, But Not to Live. A R80bn Wake-Up Call.

As the CEO and Creative Strategist at Finlite, I live in the space between two worlds. Finlite was created to bridge two worlds: a sophisticated insurance industry and millions of families making decisions based on cultural need.

The data reveals a stark contradiction:

South Africa has one of the world’s highest funeral cover rates (72%) but shockingly low life insurance (33%). We are a nation insured for death, but exposed in life.

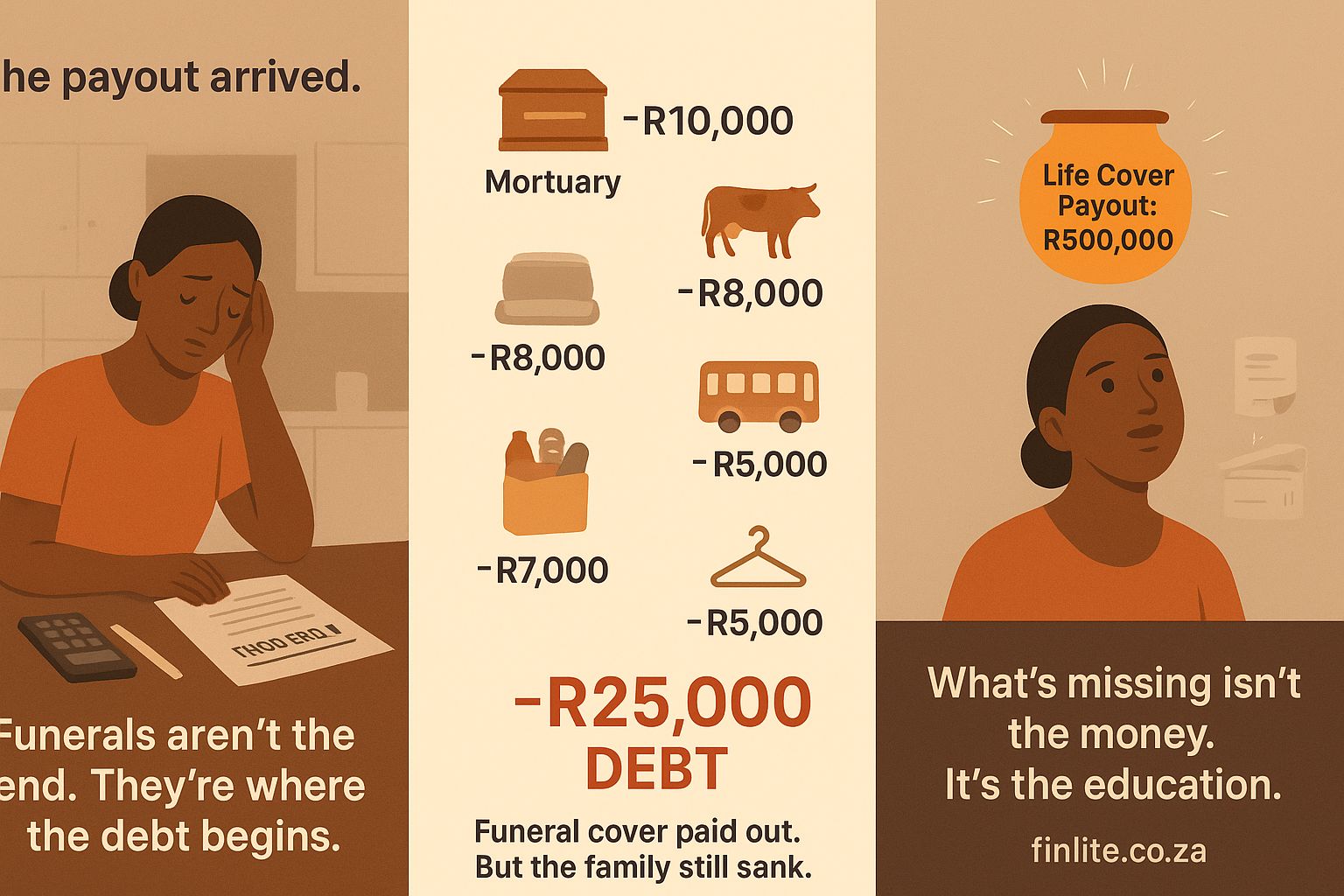

Here’s the gut-punch: A R50,000 funeral payout is quickly consumed by costs like the casket, mortuary, and transport, often leaving families with over R25,000 of debt.

This “funeral economy” is a wealth siphon, not a wealth transfer.

The Opportunity? 11 million stokvel members.

This disciplined, untapped market represents a R30+ billion annual premium opportunity for life cover. By providing R500,000 in life insurance for a realistic R250/month, we can replace funeral debt with a legacy that secures a family’s future.

Capitalising this premium stream reveals a missed embedded value of over R80 Billion for the industry. The market is not unaffordable; it is misunderstood.

The Real Barrier: The “Hand-Holding” Gap

So why has this market remained untapped? The truth is, many insurers lack the patience and empathy for the journey.

Selling here isn’t a transaction; it’s a transformation. It requires:

– Mother-tongue communication that builds understanding. Check out how we are doing this on lwaziai.co.za

– Trust-building through consistent, empathetic engagement.

– Simplifying the sophisticated: Breaking down life cover into digestible, actionable steps.

Too often, financial literacy is a compliance tick-box. But when placed at the core of strategy, it becomes your most powerful commercial engine.

The challenge is to shift from funding a dignified exit to funding a dignified life.

The underserved market doesn’t need more convincing to care about their families; they’ve already proven they do. They need a trusted partner to show them how to protect their families before a crisis hits.

The insurers willing to invest in long-term, empathetic financial education will not only be doing the right thing socially—they will be unlocking a multi-billion rand market and building an unassailable moat of trust.

The heart, it turns out, is also a very sound business strategy.

hashtag#FinancialInclusion hashtag#Insurance hashtag#WealthGap hashtag#SouthAfrica hashtag#Fintech hashtag#Stokvel hashtag#FinancialLiteracy hashtag#Finlite